New Import Rules and Tax Rates for Aromatic Polyamide Yarn

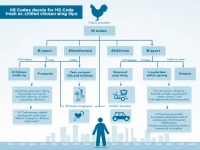

This article analyzes the tax rates and regulatory conditions for aromatic polyamide high-strength yarn under HS code 5402110000. It highlights that both export and import tax rates are zero, indicating strong market competitiveness. Additionally, it emphasizes the importance of timely updates on industry information.